Analyzing the US Asset Performance Management Market Share Dynamics

The distribution of the US Asset Performance Management Market Share is a reflection of the industry's maturity and the diverse needs of its customer base. A significant portion of the market is held by a few large, established industrial technology conglomerates. Companies like General Electric (with its Predix platform), Siemens (with its MindSphere ecosystem), and Schneider Electric (through its acquisition of AVEVA) command substantial share due to their long-standing relationships with major industrial clients, deep domain expertise, and comprehensive product portfolios that often extend beyond APM into areas like automation and enterprise software. These leaders leverage their scale to invest heavily in R&D, acquisitions, and marketing, allowing them to offer end-to-end solutions that appeal to large corporations seeking a single, reliable technology partner for their digital transformation initiatives. Their ability to integrate APM with other operational technology (OT) and information technology (IT) systems is a key competitive differentiator.

While the market leaders hold a strong position, the APM landscape is far from a monopoly. A healthy and dynamic tier of specialized software providers and challengers carves out significant market share by focusing on specific industries or technological niches. Companies such as AspenTech, a leader in the process industries, and Bentley Systems, with its strength in infrastructure and digital twins, compete effectively by offering best-of-breed solutions tailored to the unique requirements of their target sectors. Additionally, a new wave of cloud-native, AI-first startups is gaining traction by offering more agile, user-friendly, and cost-effective solutions. These newer entrants often focus on delivering rapid time-to-value and excel in specific areas like machine learning-based anomaly detection or prescriptive analytics, appealing to companies that prioritize cutting-edge technology and flexibility over the all-in-one approach of the larger incumbents.

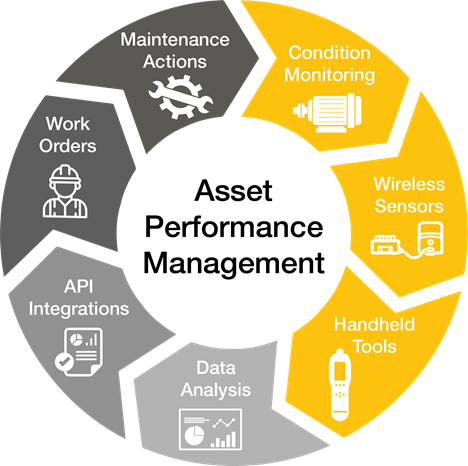

The battle for market share is increasingly being fought on the fronts of innovation, integration, and user experience. Simple data aggregation and dashboarding are no longer sufficient; customers are demanding platforms that offer advanced AI-driven insights, prescriptive recommendations, and seamless integration with their existing enterprise systems like CMMS (Computerized Maintenance Management System) and EAM (Enterprise Asset Management). Vendors that can provide an intuitive, user-friendly interface that empowers reliability engineers and maintenance technicians, rather than just data scientists, are gaining an edge. Furthermore, the ability to offer open platforms with robust APIs (Application Programming Interfaces) is becoming critical, as it allows customers to build a flexible, best-of-breed technology stack rather than being locked into a single vendor's ecosystem, a trend that is reshaping market share dynamics.

Mergers, acquisitions, and strategic partnerships play a pivotal role in shaping the competitive landscape and market share distribution. Large vendors frequently acquire smaller, innovative companies to quickly gain new technological capabilities, access to new markets, or a specialized talent pool. For example, a major player might acquire a startup with a leading-edge AI algorithm to enhance its predictive analytics offering. These strategic moves allow the incumbents to defend and expand their market share against nimble competitors. Simultaneously, partnerships between software providers, hardware manufacturers, and system integrators create powerful ecosystems that can lock in customers and capture a larger slice of the overall digital transformation budget. As the market continues to mature, this trend of consolidation and ecosystem-building is expected to accelerate, further concentrating market share among those who can offer the most complete and integrated value proposition.

With a projected leap from $1.2 billion in 2024 to $2.5 billion by 2035, the US Asset Performance Management market is on a strong growth path. This expansion, calculated at a 6.90% CAGR, underscores the industry-wide commitment to adopting smarter strategies that maximize the efficiency and longevity of critical assets.

Explore Our Latest Trending Reports: